Economic crime is

a growing problem

How can the Government keep consumers safe?

Economic crime is on the rise. Data from the Office for National Statistics for the year ending June 2021 suggests there was a 43% increase in fraud and computer misuse crimes compared to 2019.

Economic crime is a broad term used to cover all types of financial crime. This includes fraud and money laundering.

Government, regulators and crime-fighting agencies are working to tackle economic crime. The Government published its Economic Crime Plan in 2019, and there are economic crime elements in its draft Online Safety Bill.

But we don’t think the work being done is enough or urgent enough to stop the rise of economic crime, or to bring it under control.

Here’s five things we think the Government should do to help keep consumers safe.

1. Make economic crime a priority for law enforcement

Various agencies are responsible for enforcing the law around economic crime, including the National Crime Agency and the police.

During our inquiry, we heard evidence that crime agencies are not prioritising fraud and that they need more money to do so.

“It is a very small number of police resources available to deal with what is a large problem.”

Given the harm involved in economic crime, the Government should consider why it seems to not be a priority for law enforcement, and how it can ensure it does become a priority.

The Government must ensure that law enforcement agencies are appropriately resourced to tackle the scale of the problem.

2. Amend the draft

Online Safety Bill

The Government's draft Online Safety Bill is designed to deal with the problems of online harm and crime.

People we spoke to during our inquiry told us that the anti-fraud elements of the Bill need to be strengthened.

"...what the Government need to do is to swiftly introduce and give online platforms the legal responsibility to identify, remove and prevent fake and fraudulent content appearing on their sites. That should include paid-for adverts."

A Joint Committee made up of Members from both Houses of Parliament was set up to consider the Bill. It recommended in its report that the Bill be amended to include fraud offences in the list of "relevant offences" and fraud be treated as "priority illegal content".

We agree. This would mean online firms would need to actively remove fraudulent content from their platforms rather than just remove it on request.

3. Change the law on Authorised Push Payment scams

An Authorised Push Payment (APP) scam is when someone is tricked into paying money to a fraudster.

In the first half of 2021, £355.3 million was lost to APP scams. This was an increase of 71% compared to the same period in 2020.

For the first time, there is more APP fraud in the UK than card fraud.

A system was set up in 2019 that payment service providers can choose to sign up to and commit to give victims of APP fraud their money back.

The Payment Systems Regulator (PSR) thinks it should be mandatory for payment service providers to reimburse victims of APP fraud, and we agree. The Government should not delay in making changes to the law to give the PSR powers to do this.

4. Introduce regulation for the cryptoasset industry

'Cryptocurrencies' are digital currencies which are often described as 'cryptoassets'. Well known examples include Bitcoin and Ethereum.

In recent years more people have started using cryptocurrency and many new cryptocurrencies have been introduced.

They are increasingly being used for economic crime and fraud. Cryptoassets are generally not covered by existing regulation for financial assets because they are relatively new.

Consumers are often encouraged to invest in cryptocurrencies in ways that promise high return while downplaying the risk of people losing all their money.

The Advertising Standards Authority has been doing work recently to protect consumers from misleading adverts about cryptocurrencies. This is welcome, but it needs to be coordinated with proper consumer protection regulation across the whole cryptoasset industry.

5. Reform Companies House

The UK’s financial sector is large and highly regulated. This makes it attractive for money laundering because using UK companies to move money seems less suspicious.

"We have identified 929 UK companies involved in 89 cases of corruption and money laundering, amounting to £137 billion in economic damage."

Part of the problem may be Companies House, the register for companies in the UK. Issues with it have previously been identified including:

- International criminals misusing UK registered companies

- Inaccurate information held by Companies House

- Abuse of personal information on the register

- A lack of cross-checking between Companies House and other public and private sector bodies.

Reforming Companies House is essential to stop UK companies from being used to launder money and conduct economic crime. Work is being done by the Department for Business, Energy and Industrial Strategy and Companies House to modernise, but it is happening slowly.

The Government should look at how to bring in as many reforms as it can, as soon as possible, rather than waiting for the full transformation of Companies House.

What happens next?

Our report, Economic crime, was published on 2 February 2022.

We published responses from HM Treasury, the Financial Conduct Authority, and the Payment Systems Regulator on 28 April 2022.

Detailed information from our inquiry can be found on our website.

If you’re interested in our work, you can find out more on the House of Commons Treasury Select Committee website. You can also follow our work on Twitter.

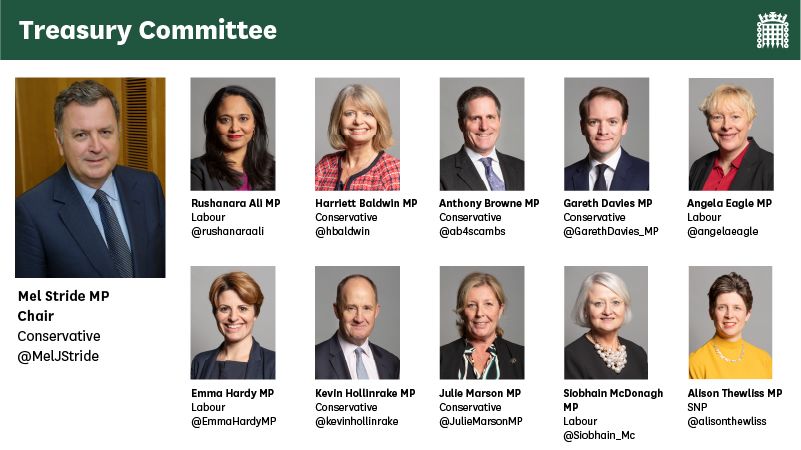

The Treasury Committee is a cross-party committee of MPs appointed by the House of Commons to examine the expenditure, administration and policy of HM Treasury, HM Revenue & Customs, and associated public bodies, including the Bank of England and the Financial Conduct Authority.

Cover image credit: stevepb on pixabay.com