Fraud represents 41% of all crime against individuals in England and Wales.

How do we break the fraud chain?

Fraud in the UK today

Fraud is the most common crime in this country today. An adult aged 16 or over in England and Wales is more likely to become a victim of fraud than any other individual crime type.

Figures show that £1.9 billion has been lost to fraud by individuals in the past year.

During the pandemic, fraud grew by 25% as COVID-19 accelerated the shift towards digitalisation. More people relied on digital banking and online shopping during lockdown, and others turned to social media and dating apps to connect with others.

Around 80% of fraud is cyber-enabled, which means that it involved technology, and social media features in thousands of fraud reports every year.

Despite this worrying rise, just 1% of police resources are focussed on economic crime. The Government’s multi-agency approach to tackling fraud is spread across several departments, agencies and working groups, leading to a cluttered policymaking environment.

On top of this, some parts of the private sector are not effectively incentivised to tackle fraud and are not taking all the steps they could to prevent it.

The result of this is that criminals based anywhere in the world can exploit digital technologies with ease to defraud millions of unsuspecting victims in the UK.

They face little risk of being caught and being brought to justice.

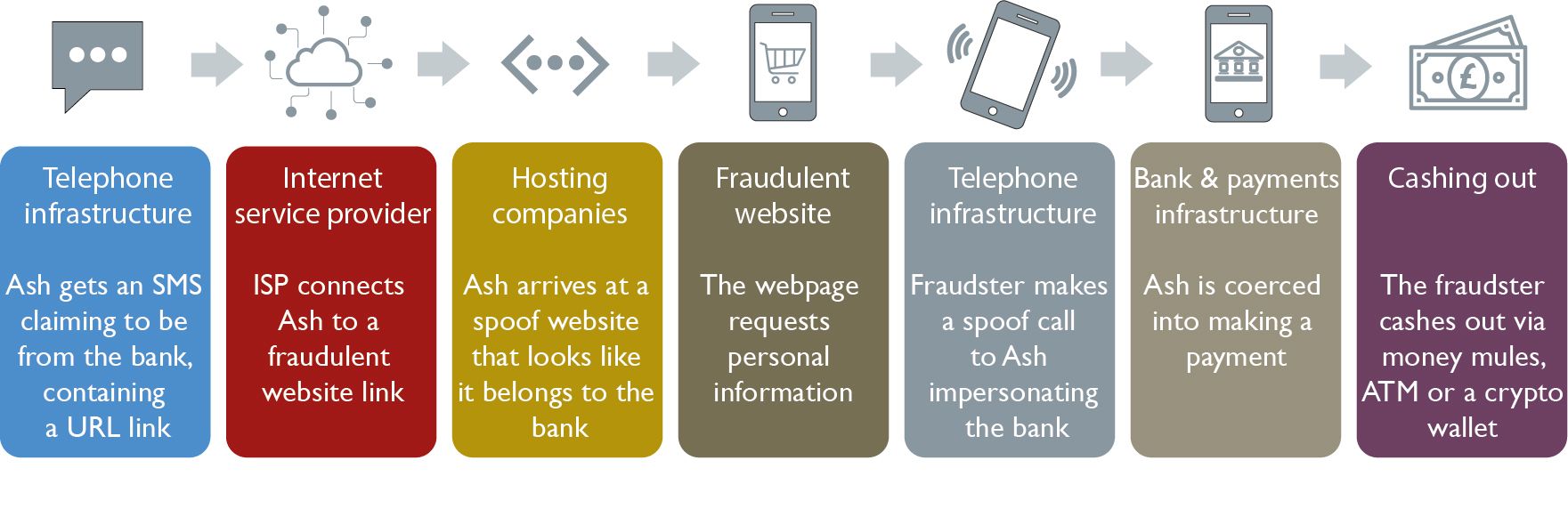

What is the fraud chain?

The fraud chain is the process by which a fraud takes place. In cases of digital fraud, this takes place using technology such as mobile phones or laptops.

Within the fraud chain there are multiple organisations that enable fraud to take place and these stakeholders often fail to put adequate systems to prevent it.

How you could become a victim in the fraud chain

Below is an example of the links in a digital banking fraud chain, however there are several different business models that fraudsters use.

What we heard

We spoke to a range of witnesses during our inquiry, including academics, experts, industry leaders and government representatives. They told us that everyone is vulnerable to fraudsters, who do not discriminate based on age, gender or background.

We also heard from victims of fraud who shared their stories with us. While victims often suffer devastating financial losses, we were told that the emotional impact can be even more traumatising, particularly as many of the victims will never see the criminals face justice.

Breaking the fraud chain

Six key recommendations

Our committee has set out six key priorities that the Government must act on to break the fraud chain.

1. Create a Cabinet sub-committee

Credit: No.10 via Flickr

Credit: No.10 via Flickr

The counter-fraud policy landscape is made up of a mind-boggling variety of acronyms and an alphabet soup of responsible departments, taskforces and Ministers. This leads to inefficient policymaking and a lack of accountability.

A cabinet sub-committee with a clear mandate to tackle fraud should be established, chaired by and accountable to the Security Minister.

The sub-committee should bring together more effectively all Secretaries of State who have a portfolio that spans fraud. To ensure transparency, its membership and terms of reference should be made public.

2. Strategic Policing Requirement

Credit: Unsplash

Credit: Unsplash

Currently, just 1% of law enforcement is focussed on tackling economic crime. Digital investigation remains outside the capacity of mainstream policing and the organisational structure for policing fraud is complex and confusing.

To tackle under-prioritisation, fraud should be written into the Strategic Policing Requirement.

3. New criminal offences

Credit: Adobe Stock

Credit: Adobe Stock

There are several sectors involved in the fraud chain, but not all face the same incentives to tackle the problem. Until all fraud-enabling industries fear significant financial, legal and reputational risk for their failure to prevent fraud, they will not act.

To inspire behaviour change, we call on the Government to introduce a new corporate criminal offence of 'failure to prevent fraud', accompanied by significant financial penalties, to hold corporates across all sectors to account.

The Government must make it clear that a range of other measures, such as director disqualification, are ready to be enforced if culture change is not forthcoming.

4. A consumer awareness campaign

Credit: Adobe Stock

Credit: Adobe Stock

There remains no national public awareness campaign to provide help and support for the general public on how to protect themselves against fraud, and to educate them on how it can be reported.

This creates confusion on what advice to follow, as well as a lack of clarity for victims, which can lead to under-reporting.

The Government should oversee the introduction of a single, centrally funded consumer awareness campaign in partnership with industry.

This should align with the priorities established in the forthcoming Fraud Strategy and should provide clear guidance on how fraud can be reported.

5. Slow down banking payments

Credit: Unsplash

Credit: Unsplash

The UK has one of the most advanced digital banking systems in the world. While beneficial for businesses and consumers at large, this makes the UK a lucrative market for fraudsters looking to cash out stolen funds quickly and easily.

To stop fraudulent payments slipping through the net, the speed with which certain payments can be made should be subject to a delay lasting no more than several hours. This might include high-value payments made by personal customers to new payees, with an option to extend this to existing payees in the case of high-value payments.

The Payment Systems Regulator should consult with industry on the introduction of such a measure and the value threshold to be set. Implementation of this measure must not impact the application of other measures such as AI-assisted transaction monitoring.

6. Reintroduce the Online Safety Bill

Credit: Adobe Stock

Credit: Adobe Stock

The Online Safety Bill contains several important measures to prevent fraudulent content and scam advertising from appearing on online platforms and to hold tech companies accountable when they fail.

It must be brought forward urgently.

Find out more

Read the full report on our website

Find out more about our inquiry and our committee

Follow us on Twitter @HLFraudActCom.